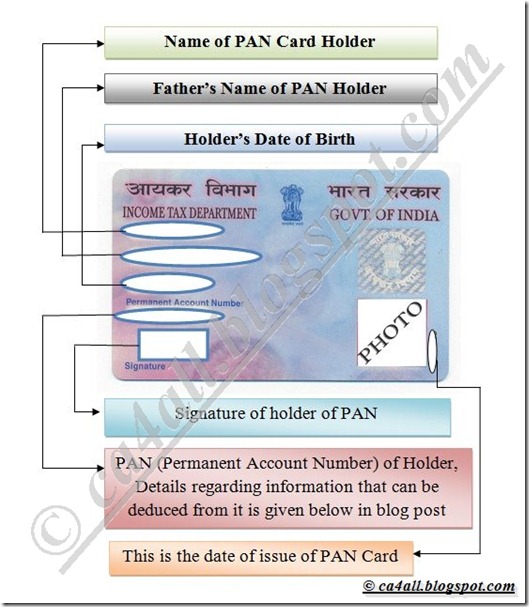

PAN or Permanent Account Number is unique alphanumeric combination provided to entities which are identifiable under the Income Tax Act, 1961.The basic purpose of assigning this number to an entity is to track down substantial flow of monetary resource to and fro through such an entity via this number. Hence, assigning this number and making its role mandatory in major financial transactions ensures that evasion of tax is checked. PAN also serves as an important Id proof document. PAN; as acronym depicts is “Permanent” and is unique to every entity. PAN is allocated to variety of “entities”, viz. Company, Individuals, HUF, Trusts, Societies, AOPs etc. Structure of a PAN Card is given below:

Permanent Account Number is framed in such a manner that it reveals some details about its holder, suppose the PAN is AAAAA9999A; Then,

- The fourth Letter in PAN tells us about the type of Assesse :

- A – AOP

- B – BOI

- C – Company

- F – Firm

- G – Government

- H – HUF

- J – Artificial Judicial Person

- L – Local Authority

- P – Person

- T – Trust

- Fifth letter of Permanent Account Number is :

- First character of Surname in case of Person

- First character of name for assesses other than a Person(Individual)

-

Next four characters “9999” in this case, are numbers ranging from 0001 to 9999

-

Last letter is “Alphabetic Check Digit”

Importance of PAN -