|

Unknown |

|

at 10:11 AM |

|

ca4all Companies Act Corporate Law Indian Companies Act Law News Updates |

|

Unknown |

|

at 7:34 AM |

|

ca4all Downloads Notification RBI |

|

Unknown |

|

at 7:28 AM |

|

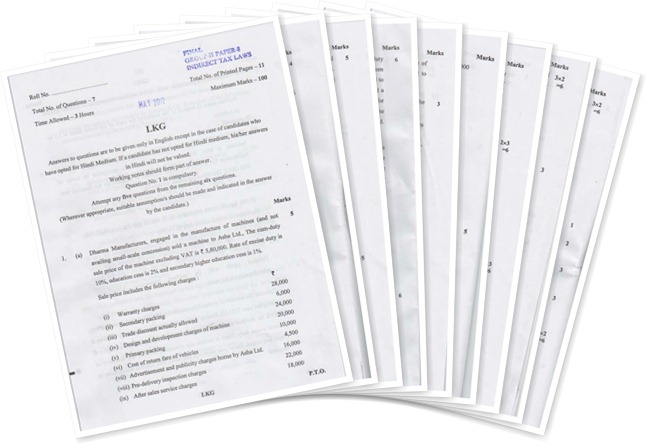

Accounts CA Final ca4all Corporate Law Downloads ICAI November 2012 Question Papers |

|

Unknown |

|

at 10:18 AM |

|

Accounts AMA Audit CA Final ca4all Downloads DT ICAI IDT ISCA Law November 2012 RTP Updates |

|

Divya Singhal |

|

at 10:44 AM |

|

CA Final ca4all ICAI IDT IPCC November 2012 Taxation Updates |

|

Divya Singhal |

|

at 6:32 AM |

|

Announcement ca4all Group 2 ICAI Information Technology IPCC IT November 2012 Updates |

Exclusion of certain topics from ITSM Syllabus for November,2012 Attempt & Onwards

Certain topics from ITSM syllabus have been excluded for the purpose of November,2012 attempt and onwards, relevant announcement regarding the same can be read on BOS portal

|

Divya Singhal |

|

at 5:28 AM |

|

Accounts Amendments Downloads Income Tax IPCC Law November 2012 Study Material Updates |

Amendments for IPCC November 2012 Attempt

|

Divya Singhal |

|

at 4:23 AM |

|

Banks ca4all Finance Financial Analysis Financial Management Updates |

How Banks make Money ?–A Quick Analysis

Retail Banking –

|

Divya Singhal |

|

at 6:39 AM |

|

Audit CA Final ca4all CARO 2003 Downloads Group 1 Group 2 Hindi Hindi Notes IPCC Notes Study Material Theory Updates |

CARO 2003 Audit Notes in Hindi - कंपनी अंकेक्षक प्रतिवेदन आदेश - 2003

|

Divya Singhal |

|

at 1:11 AM |

|

CA Final ca4all Companies Act Company Corporate Law Downloads Handbook Indian Companies Act IPCC Law Membership of Company Study Material Updates |

Membership of Company - A Handbook

|

Divya Singhal |

|

at 5:27 AM |

|

Accounts ca4all Downloads FM Group 1 Group 2 ICAI Income Tax Information Technology IPCC Law November 2012 RTP Study Material Updates |

|

Divya Singhal |

|

at 4:16 AM |

|

CA Final ca4all Companies Act IPCC Law |

Definition Of Member as per Companies Act,1956

Definition of member — Section 41 Companies Act,1956

All the subscribers of the Memorandum of Association shall be deemed to

Section 41 deals with definition of member which provide as under:—

- The subscribers of the Memorandum of a company shall be deemed to have agreed to become members of the company, and on its registration, shall be entered as members in its register of members

- Every other person who agrees in writing to become a member of a company and whose name is entered in its register of members, shall be a member of the company

- Every person holding equity share capital of a company and whose name is entered as beneficial owner in the records of the depository shall be deemed to be a member of the concerned company

|

Divya Singhal |

|

at 10:56 AM |

|

Announcement ca4all CPT ICAI News Updates |

DIRECT ENTRY TO CHARTERED ACCOUNTANCY COURSE – AMENDMENTS TO THE CHARTERED ACCOUNTANTS REGULATIONS, 1988

|

Divya Singhal |

|

at 12:26 PM |

|

ca4all IPCC SM Strategic Management Theory |

Total Quality Management (TQM)

Total Quality Management (TQM) is a people focused management system that aims at continual increase in customer satisfaction at continually lower real cost.

TQM is total system approach, not a separate area or program. TQM stresses continual change in learning and adaptation as keys to organizational success.

Pioneers in field of TQM argued that a more effective management philosophy might focus on actions to prevent a defective products from ever being created, rather that simply screening it out.

W. Edwards Deming is regarded by many as Father of TQM

TQM & Traditional management practices -

- Strategic planning and management

- Changing relationships with customers and suppliers

- Organizational Structure

- Motivation & Job design

- Organizational Change

- Teamwork

|

Divya Singhal |

|

at 1:04 AM |

|

CA Final ca4all Group 1 Group 2 ICAI Information Technology IPCC ISCA Theory Updates |

Bullwhip/Whiplash Effect & The Factors Contributing to Bullwhip Effect

A Phenomenon in forecast driven distribution channels/ A problem in forecast driven supply chains.

In periods of rising demand, down stream participants will increase their orders. In periods of falling demand, orders will fall or stop in order to reduce inventory.

The effect is that; variations are amplified the farther one gets from the end-consumers.

Factors Contributing To Bullwhip Effect -

|

Divya Singhal |

|

at 11:47 PM |

|

CA Final ca4all Downloads Group 2 ICAI May 2012 Question Papers Taxation Updates |

|

Divya Singhal |

|

at 9:31 AM |

|

CA Final ca4all Downloads DT Group 2 ICAI Income Tax May 2012 Question Papers Taxation Updates |

|

Divya Singhal |

|

at 9:21 AM |

|

CA Final ca4all Downloads Group 2 ICAI ISCA May 2012 Question Papers |

|

Divya Singhal |

|

at 7:42 AM |

|

AMA CA Final ca4all Costing Downloads ICAI May 2012 Question Papers Updates |

|

Divya Singhal |

|

at 11:43 AM |

|

CA Final ca4all Downloads Group 1 ICAI May 2012 Question Papers Updates |

CA Final May 2012 Question Papers Group 1

|

Divya Singhal |

|

at 11:23 AM |

|

CA Final ca4all ICAI News Updates |

In News : 300 candidates clear CA Final after Retotaling

Check this news by following this link (Original Article on Times Of India)

http://articles.timesofindia.indiatimes.com/2012-05-16/chennai/31725898_1_lakh-students-lecturer-final-exams

Courtsey : http://timesofindia.indiatimes.com/

|

Divya Singhal |

|

at 9:50 AM |

|

ca4all Downloads Group 2 ICAI IPCC May 2012 Study Material Updates |

Solutions: IPCC May 2012 Model Test Papers Series 2 Group 2

|

Divya Singhal |

|

at 9:25 AM |

|

ca4all Downloads Group 2 ICAI IPCC May 2012 Study Material Updates |

IPCC May 2012 Model Test Papers Series 2 Group 2

GROUP 2

Paper 5: Advanced Accounting

Download Here

Paper 6: Auditing & Assurance

Download Here

Paper 7: Information Technology & Strategic Management

Download Here

For Solutions Click

HERE

|

Divya Singhal |

|

at 9:53 AM |

|

A Lesson of Faith by Einstein - Motivation & Perception

Professor : You are a Believer of God, aren’t you, son ?

Student : Yes, sir.

Professor: So, you believe in GOD ?

Student : Absolutely, sir.

Professor : Is GOD good ?

Student : Sure.

Professor: Is GOD all powerful ?

Student : Yes.

Professor: My brother died of cancer even though he prayed to GOD to heal him. Most of us would attempt to help others who are ill. But GOD didn’t. How is this GOD good then? Hmm?

(Student was silent)

Professor: You can’t answer, can you ? Let’s start again, young fella. Is GOD good?

Student : Yes.

|

Divya Singhal |

|

at 4:35 AM |

|

ca4all Downloads ICAI IPCC May 2012 Updates |

Solutions: IPCC May 2012, Model Test Papers Series 1

GROUP 1

Paper 1: Accounting

Download Here

Paper 2: Law, Ethics & Communication

Download Here

Paper 3: Costing & Financial Management

Download Here

Paper 4: Taxation

Download Here

GROUP 2

Paper 5: Advanced Accounting

Download Here

Paper 6: Auditing & Assurance

Download Here

Paper 7: Information Technology & Strategic Management

Download Here

|

Divya Singhal |

|

at 3:57 AM |

|

ca4all Downloads ICAI IPCC Updates |

IPCC May 12 Model Test Papers Series 1

GROUP 1

Paper 1: Accounting

Download Here

Paper 2: Law, Ethics & Communication

Download Here

Paper 3: Cost Accounting & Financial Management

Download Here

Paper 4: Taxation

Download Here

GROUP 2

Paper 5: Advanced Accounting

Download Here

Paper 6: Auditing & Assurance

Download Here

Paper 7: Information Technology & Strategic Management

Download Here

|

Divya Singhal |

|

at 7:41 PM |

|

Downloads Group 1 Group 2 ICAI IPCC May 2012 RTP Study Material Updates |

IPCC Revision Test Papers(RTP) May 2012

|

Divya Singhal |

|

at 4:46 PM |

|

Assessment of HUF after partition as per Section 171

- When at assessment, it is said by any member that HUF has been partitioned wholly or partially; Assessing Officer may inquire by giving notice to all members

- On completion of inquiry by assessing officer, AO shall record the findings as to whether there has been whole or partial partition and if there has been such partition; the date on which it has taken place

- Where a partial partition has taken place after 31st December, 1978, no claim that such partial partition has taken shall be inquired into and no findings shall be recorded. Such family shall continue to be liable to be assessed as if no such partition has taken place. It shall be assessed as HUF

- Where a finding of total/partial partition has been recorded by the AO and partition took place during the previous year, the total income of the family in respect of the period upto the date of such partition shall be assessed as if

|

Divya Singhal |

|

at 9:02 AM |

|

ca4all Humour Taxation |

|

Divya Singhal |

|

at 9:41 AM |

|

ca4all HUF Income Tax Taxation |

Incomes not treated as those of HUF & deductions available from GTI to HUF

- Income from property transferred to a member

- Income from property transferred to the family

- Income from personal business of a member

- Incomes in case only one coparcener is there in Dayabhag School

- Income earned by personal efforts of a member

- Impartible estate

|

Divya Singhal |

|

at 7:27 AM |

|

CA Final ca4all HUF Income Tax Law Taxation |

Conditions for being assessed as HUF

The following can be regarded as the two main conditions which are required to be complied with for being assessed as a Hindu Undivided Family(HUF) -

- There should be coparceners

- There should be any common property of the family

Here, “coparceners” refers to two or more individuals inheriting any property together, or in other words two or more people who are co-heirs, and have rights on the property that they inherit

|

Divya Singhal |

|

at 2:50 AM |

|

CA Final ca4all HUF Income Tax Law Taxation |

Hindu Undivided Family(HUF) - Meaning & Types

- Mitakshra

- Dayabhag

|

Mr. Divya Singhal |

|

at 8:01 AM |

|

ca4all Financial Analysis Financial Management FM IPCC |

Importance of Financial Statement Analysis

- Estimation of future earning capacity along with computation of present earning capacity

- Inter Firm Comparison

- Determination of short as well as long term solvency of the firm

- Finding out overall and department-wise efficiency of firm on the basis of available financial information

- Assessing development in future by making forecasts and preparing budgets

- Focusing the attention on general financial strength of the business enterprise

|

Mr. Divya Singhal |

|

at 7:24 AM |

|

ca4all Financial Analysis Financial Management FM IPCC Theory |

Financial Analysis - Meaning and Objects

|

| Financial Analysis - Meaning and Objects |

- To find out financial stability of a business concern

- To assess the earning capacity of the firm

- To estimate and evaluate the stock and fixed assets of the concern

- To assess the firm's capacity and ability to repay short term and long term loans

- To expect about the administrative efficiency of the management of the business concern

- To estimate and examine the possibility of future growth of business

|

Divya Singhal |

|

at 12:54 AM |

|

ca4all Corporate Law Downloads Income Tax Updates |

Major highlights of Union Budget 2012-13

|

Divya Singhal |

|

at 8:51 AM |

|

ca4all Downloads Updates |

Major highlights of Railway Budget 2012-13

including the

List of New Trains Announced in the Railway Budget 2012-13

|

Divya Singhal |

|

at 4:10 AM |

|

Books CA Final Downloads ICAI |

Latest Study Material For CA Final(New) Issued By ICAI

|

Divya Singhal |

|

at 9:22 AM |

|

CA Final ca4all Companies Act Company Corporate Law Directors Indian Companies Act IPCC Law |

Duties Of Directors

Duties of Directors may be categorized as -

Click on the above Links to see the Categorized duties in details

|

Divya Singhal |

|

at 9:09 AM |

|

CA Final ca4all Companies Act Company Corporate Law Directors Indian Companies Act IPCC Law |

Statutory Duties of Directors, i.e, Duties of Directors under the Companies Act

- To act according to Articles

- To ensure full and correct disclosure in Prospectus

- To sign the Prospectus

- To deliver prospectus to Registrar before issue

- To keep deposited application money in a Scheduled Bank

- To file the Return of Allotment

- To deliver the Share Certificates

- To pay the amount on shares taken

- To sign and file Annual Return

- To prepare and send copy of Statutory Report

- To call Annual General Meeting

- To lay accounts before AGM

|

Divya Singhal |

|

at 8:52 AM |

|

CA Final Companies Act Company Corporate Law Directors Indian Companies Act IPCC Law |

General Duties Of Directors

- Duty of good faith

- Duty of not delegating the Powers

- Duty to act with due Care and Diligence

- Duty to ensure proper usage of Money

- Duty of not using Corporate Opportunities for Personal Interest

- Duty of not paying Dividend out of Capital

|

Divya Singhal |

|

at 7:30 AM |

|

ca4all Income Tax IPCC Section Taxation |

Some Exceptional Cases Where Income Is Assessed In The Same Previous Year In Which It Is Earned

-

Income from Shipping Business of Non-Residents (Section 172)

-

Assessment of a Person leaving India (Section 174)

-

Assessment of a Person likely to transfer property to avoid Tax (Section 175)

-

Assessment of Income of Discontinued Business (Section 176)

|

Divya Singhal |

|

at 10:58 AM |

|

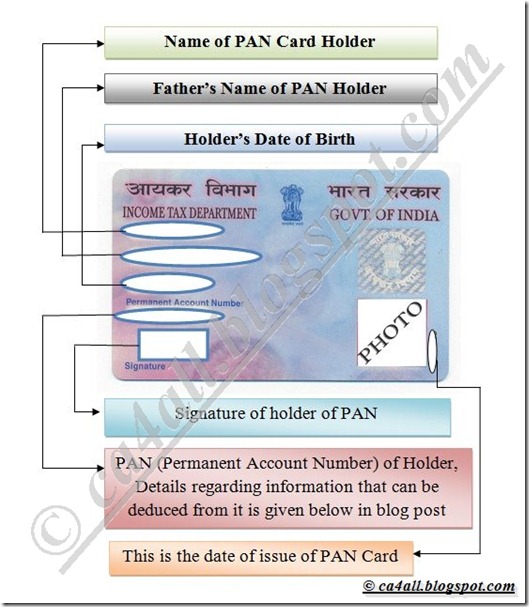

Diagrams General Income Tax PAN Pan card |

PAN (Permanent Account Number) –What does it tell ?

PAN or Permanent Account Number is unique alphanumeric combination provided to entities which are identifiable under the Income Tax Act, 1961.The basic purpose of assigning this number to an entity is to track down substantial flow of monetary resource to and fro through such an entity via this number. Hence, assigning this number and making its role mandatory in major financial transactions ensures that evasion of tax is checked. PAN also serves as an important Id proof document. PAN; as acronym depicts is “Permanent” and is unique to every entity. PAN is allocated to variety of “entities”, viz. Company, Individuals, HUF, Trusts, Societies, AOPs etc. Structure of a PAN Card is given below:

Permanent Account Number is framed in such a manner that it reveals some details about its holder, suppose the PAN is AAAAA9999A; Then,

- The fourth Letter in PAN tells us about the type of Assesse :

- A – AOP

- B – BOI

- C – Company

- F – Firm

- G – Government

- H – HUF

- J – Artificial Judicial Person

- L – Local Authority

- P – Person

- T – Trust

- Fifth letter of Permanent Account Number is :

- First character of Surname in case of Person

- First character of name for assesses other than a Person(Individual)

-

Next four characters “9999” in this case, are numbers ranging from 0001 to 9999

-

Last letter is “Alphabetic Check Digit”

Importance of PAN -

|

Mr. Divya Singhal |

|

at 11:00 AM |

|

Codes Diagrams Enterprise Software Information Technology IT SAP |

.jpg)